Basic Bookkeeping for Small Business: Your Comprehensive Guide

Understanding the importance of basic bookkeeping for small business is crucial for maintaining financial health and ensuring organizational success. Proper bookkeeping not only allows you to track income and expenses but also provides valuable insights for making informed business decisions. This article aims to provide an in-depth understanding of basic bookkeeping concepts, practical tips, and the benefits of maintaining accurate financial records.

1. What is Basic Bookkeeping?

Bookkeeping is the process of recording financial transactions that occur in a business. It is a systematic method to track all incoming and outgoing financial data, including sales, purchases, receipts, and payments. For small businesses, bookkeeping serves as the backbone of your financial system, ensuring that you can assess your business's performance and comply with tax obligations.

2. The Importance of Bookkeeping for Small Businesses

Basic bookkeeping for small business is not just about keeping track of numbers; it plays a significant role in various aspects of your business, including:

- Financial Reporting: Accurate bookkeeping enables you to create financial statements like balance sheets and profit and loss statements.

- Budgeting and Forecasting: Understanding past financial performance helps in creating budgets and forecasting future revenues and expenses.

- Tax Compliance: Proper records ensure that you meet all tax obligations, minimizing the risk of audits and penalties.

- Business Planning: Good financial records help you make strategic decisions, allowing for better business planning and growth.

3. Fundamental Principles of Basic Bookkeeping

When embarking on your bookkeeping journey, it's essential to understand the fundamental principles that guide the process:

3.1 Double-Entry System

The double-entry bookkeeping system ensures that every financial transaction affects two accounts: one account is debited, and another is credited. This method helps maintain the accounting equation: Assets = Liabilities + Equity.

3.2 Consistency

Maintaining consistency in your bookkeeping practices ensures that records are reliable and comparable over time. This means sticking to the same accounting methods and principles throughout your reporting periods.

3.3 Accurate Record-Keeping

Accurate and timely record-keeping is vital. You should record transactions as they occur to avoid missing any critical entries that could affect your financial statements.

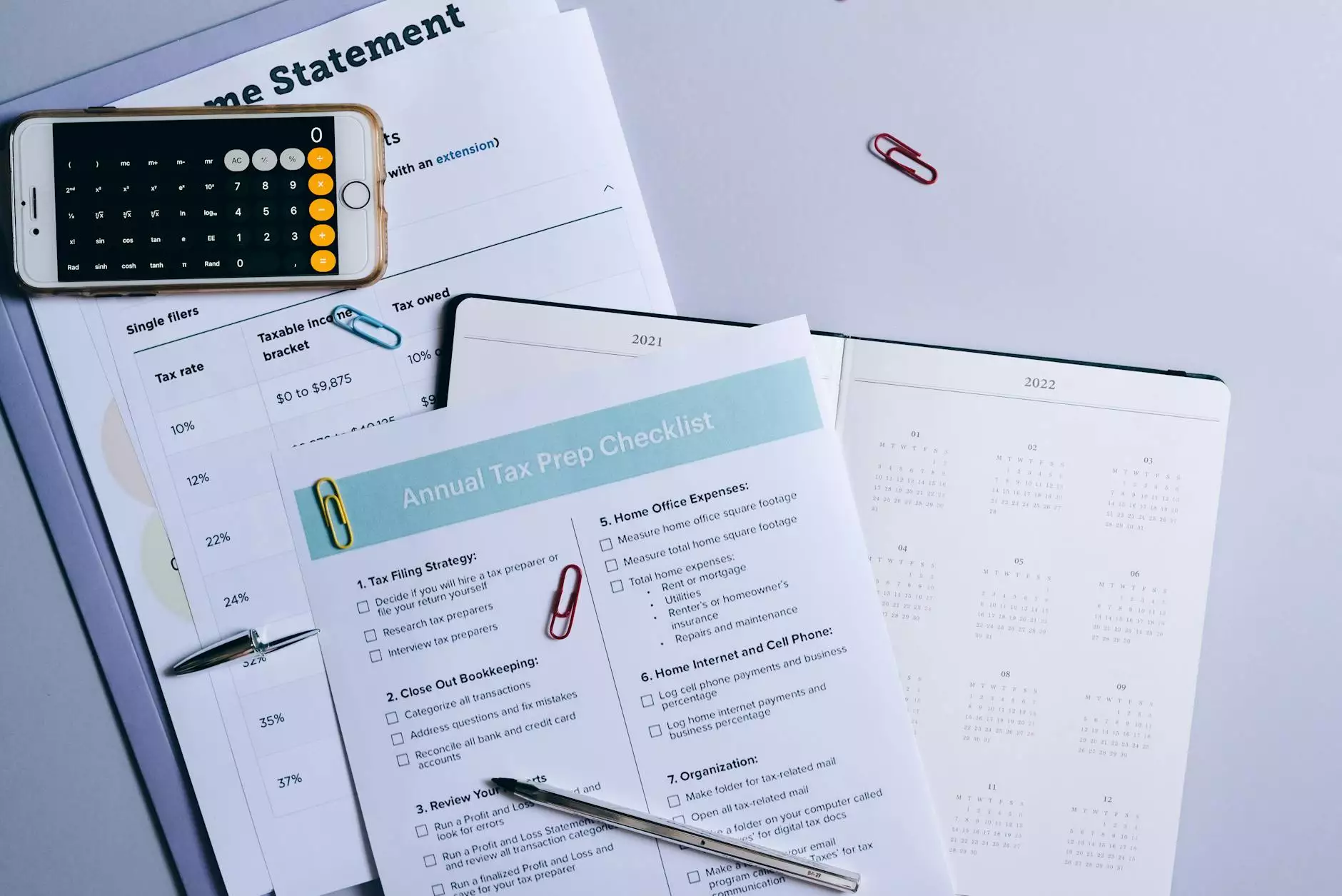

4. Basic Bookkeeping Tasks for Small Business Owners

As a small business owner, several essential bookkeeping tasks will help you maintain accurate financial records:

4.1 Tracking Income and Expenses

Tracking all sources of income and every expense is fundamental. Use accounting software or spreadsheet tools to categorize these transactions. Regularly monitor your inflow and outflow to gain insights into your financial health.

4.2 Managing Invoices

Invoice management is crucial. Ensure to send invoices promptly, follow up on unpaid invoices, and monitor payment statuses. Keeping an organized system for invoices helps maintain cash flow.

4.3 Reconciling Bank Accounts

Regularly reconciling your bank statements with your internal records is essential. This process helps identify discrepancies that may need correction and ensures that your records match your financial institution’s data.

4.4 Payroll Management

If you have employees, managing payroll accurately is vital. Ensure to record hours worked, calculate wages, and withhold the correct taxes. Set up regular intervals for payroll processing to stay compliant with labor laws.

5. Essential Tools for Basic Bookkeeping

To streamline the bookkeeping process, consider using various tools and software designed for small businesses:

- Accounting Software: Platforms like QuickBooks, Xero, or FreshBooks make it easier to manage financial records, invoicing, and reporting.

- Spreadsheets: For those who prefer manual bookkeeping, programs like Microsoft Excel or Google Sheets can be powerful tools for tracking finances.

- Banking Tools: Most banks provide online tools to help you categorize transactions and simplify account management.

- Expense Tracking Apps: Applications such as Expensify or Receipt Bank can assist in tracking expenses on the go.

6. The Role of an Accountant in Small Business Bookkeeping

While many small business owners choose to manage their bookkeeping, the expertise of an accountant can be incredibly beneficial. Here’s how:

6.1 Expert Guidance

Accountants have the training and experience to guide you through complex financial situations, helping you make informed decisions that can benefit your business.

6.2 Tax Efficiency

An accountant can ensure that your bookkeeping is organized and compliant, maximizing deductions and minimizing tax liabilities.

6.3 Time-Saving

By outsourcing your bookkeeping to an experienced accountant, you can save valuable time and focus on growing your business rather than getting lost in financial details.

7. Common Bookkeeping Mistakes to Avoid

Even with the best intentions, bookkeeping mistakes can happen. Here are some common errors to avoid:

- Neglecting Receipts: Always keep receipts for your expenses. Digital tools can help you store and organize these records efficiently.

- Mixing Personal and Business Finances: Keep your personal and business accounts separate to avoid confusion and potential tax issues.

- Failing to Reconcile Accounts: Regular reconciliation of accounts can help catch errors early and maintain accuracy.

- Delaying Entries: Don't leave your bookkeeping to the end of the month or year. Make a habit of entering transactions regularly.

8. Conclusion

Mastering basic bookkeeping for small business is essential for maintaining financial stability and growth. By implementing sound bookkeeping practices, utilizing the right tools, and potentially engaging professional help, your business can achieve better financial health and pave the way for future success. Continual education and refinement of your bookkeeping processes will enhance your overall business effectiveness.

For more information about how to manage your bookkeeping effectively, visit booksla.com, your resource for financial services, advising, and accounting solutions.